In working towards alleviating the many problems of the textile supply chain in India, Locofast has partnerships with both big and small textile suppliers and manufacturers across the country. In fact, in the two years since its inception, Locofast has managed to connect 500+ suppliers with over 700+ domestic and international brands. This exponential growth can be attributed to many factors including the Locofast promise of consistent business opportunities, advantageous prices, assured quality, and simply convenience. However, there is one other factor that secures its many customers, which is the financial support that Locofast offers.

Locofast started offering financial assistance based on the feedback the team received from the earliest customers. Many of those customers were owners of small and medium enterprises, or SMEs, who had been hit hard by the lockdowns imposed during the first year of the pandemic, and who then pitched this idea after they were forced to either shut down their businesses due to zero cash flow, or borrow money at exorbitant rates of interest in order to keep their businesses afloat. Keeping in mind their precarious circumstances and motivated by a desire to aid these businesses restore their footing in the industry, Locofast decided to provide financial support services to all customers who might require it.

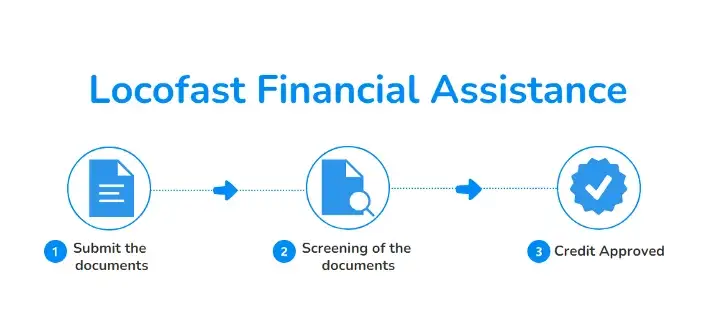

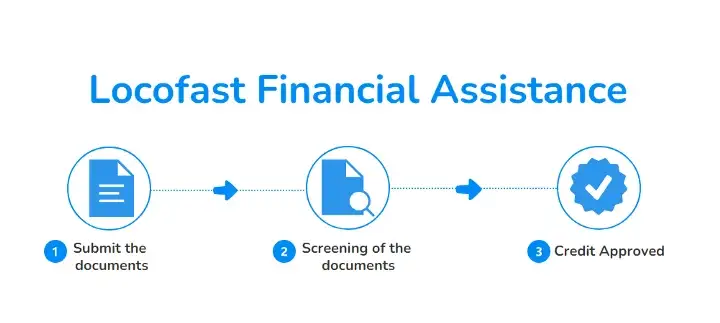

The process to apply for financial assistance is very simple. Those customers who are placing an order for the first time and who require financial assistance only need to get in touch with the sales team over the phone, while the older customers simply need to contact their sales executive. Once the request has been placed, the Locofast team makes a decision within 2–3 working days, and the customer is subsequently informed if their request has been approved.

The most frequent form of financial assistance that partners qualify for is in the form of credit loans. This means that if the customers are unable to furnish the entire bill for their order beforehand, they can defer the payment for the goods they have acquired up to a period of one, two or three months. Essentially, what this means is that struggling customers have the option to make and procure their purchases in credit, and pay the bill as soon as they can make a profit. If a situation arises where they are unable to pay the whole amount in the decided period of time, they only have to pay a nominal penalty fee along with the remaining balance. The basic idea with this is to help customers in managing their working capital.

This option of financial assistance has proved to be wildly popular amongst the customers. Not only is the entire process of getting a credit loan easy, but our team ensures that customers have a hassle-free onboarding experience with minimal documentation. Furthermore, the contract between the two parties has easy payment terms that don’t harm the business, and prevents compounded loss in the long run. Most importantly, it allows our customers to make calculated investments in the future of their business.